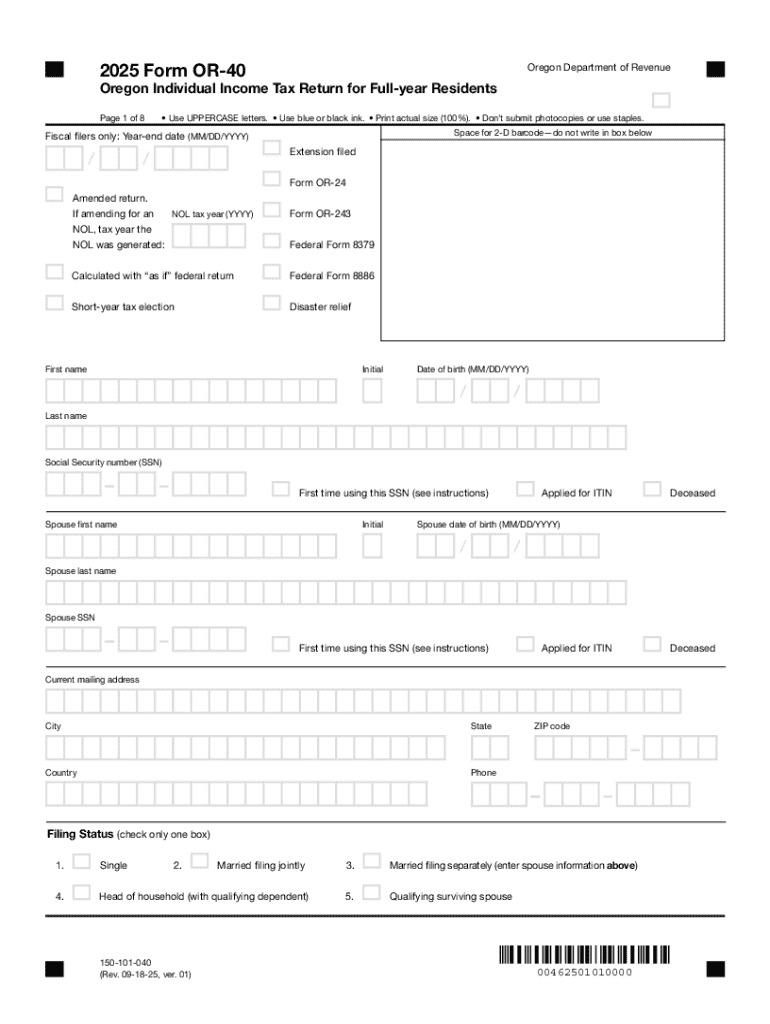

OR DoR OR-40 2025-2026 free printable template

Get, Create, Make and Sign OR DoR OR-40

How to edit OR DoR OR-40 online

Uncompromising security for your PDF editing and eSignature needs

OR DoR OR-40 Form Versions

How to fill out OR DoR OR-40

How to fill out 2025 form or-40 oregon

Who needs 2025 form or-40 oregon?

A Complete Guide to the 2025 OR-40 Oregon Form

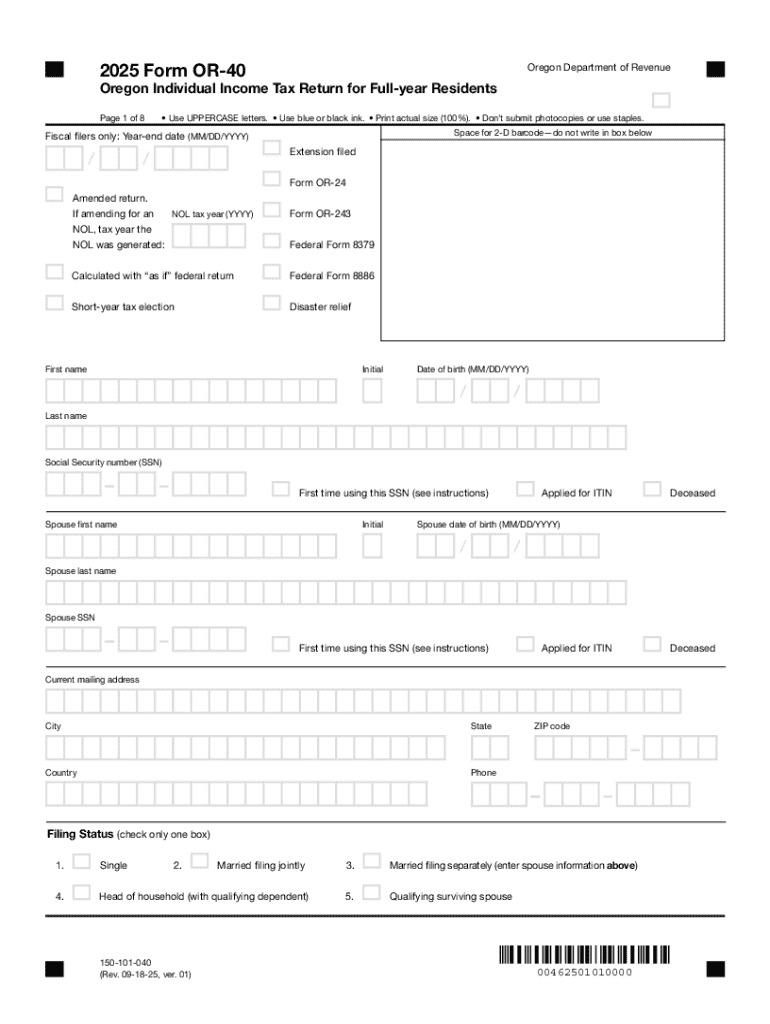

Overview of the 2025 OR-40 Oregon Form

The 2025 OR-40 form is the primary income tax form for residents of Oregon. Its key purpose is to report annual income, calculate tax liability, and claim various deductions and credits available under Oregon laws. Filing this form is essential for ensuring compliance with state tax regulations and maintaining good standing with the Oregon Department of Revenue.

Individuals who need to file the OR-40 form typically include Oregon residents earning income above certain thresholds. It is crucial for employees, freelancers, and individuals with other sources of income to complete this form accurately and submit it on time to avoid potential penalties.

Ensuring accurate completion of the OR-40 form not only affects the amount of tax owed but also determines eligibility for possible refunds or federal credits. State deadlines for submission are strict, making timely filing a key priority.

Key updates and changes for the 2025 OR-40

For the 2025 tax year, there are several updates and legislative changes impacting the OR-40 form. One noteworthy change is the adjustment in income thresholds, which are tied to inflation and fiscal policies enacted by the Oregon legislature.

Additionally, modifications to deductions and tax credits have been introduced. For instance, the Oregon standard deduction may see an increase, allowing more taxpayers to lower their taxable income, and specific credits aimed at low-income families may have expanded eligibility criteria.

These updates necessitate that taxpayers stays updated to avoid missing out on potential savings and to ensure compliance with Oregon tax laws.

Step-by-step guide to completing the 2025 OR-40 form

Step 1: Gather required documentation

Before you begin filling out the OR-40 form, it is imperative to gather all necessary documentation. This includes W-2 forms from employers, 1099 forms for freelance or contract work, statements of any interest or dividends received, and records of any other income. Proper organization of these documents can significantly expedite the filing process.

Step 2: Fill out the personal information section

The initial section of the OR-40 form requires personal information including your name, Social Security number, and address. Ensure that all data is accurate, as discrepancies can lead to delays in processing your return. A common mistake in this section is typos in names or incorrect Social Security numbers, so thorough double-checking is advisable.

Step 3: Report your income

In this section, you will provide detailed information on various sources of income. Report income from employment, freelance work, rental properties, and any interest or dividends received. Oregon requires that all income, regardless of its source, be reported accurately. A detailed breakdown should be provided based on the income lines of the form.

Step 4: Claim deductions and credits

To reduce your taxable income, claim all eligible deductions and credits. Deductions may include medical expenses, education-related costs, and contributions to retirement accounts. Understanding how to qualify for these deductions as an Oregon resident can help maximize your tax refund.

Step 5: Calculate your tax liability

Upon reporting your income and claiming deductions, calculate your overall tax liability. Oregon has varying tax rates depending on income levels, so consult the latest tax rate tables available from the Oregon Department of Revenue to determine how much tax you owe.

Step 6: Review and double-check your form

Before submitting, review your OR-40 form thoroughly. Confirm that all entries are accurate and complete. A checklist of common errors includes checking for missing signatures, inconsistent income figures, or incorrect calculations. Addressing these can save time and headaches later.

Interactive tools for completing your OR-40 form

Using digital resources such as pdfFiller can significantly streamline the completion of your OR-40 form. Its interactive tools allow for auto-fill capabilities, which reduce data entry time and minimize errors. The platform also supports e-signatures, making the process of signing and submitting your form easier and more secure.

Real-time collaboration features are also available, allowing multiple users to work on a document concurrently. This is especially beneficial for taxpayers who may be seeking help from tax professionals or who need to involve partners in their filing process. The cloud-based architecture ensures that your documents can be accessed and edited from anywhere, enhancing convenience.

Electronic filing options for the OR-40 form

Oregon taxpayers can choose to file their OR-40 form electronically, which is often faster and more efficient than paper filing. To submit electronically, you'll need to use approved e-filing platforms like pdfFiller. The e-filing system allows taxpayers to fill out, file, and track their OR-40 submissions conveniently.

E-filing offers benefits over paper filing, including faster processing times and instantaneous submission confirmation. Additionally, e-filing platforms may provide enhanced tracking features, making it easier to check the status of your submission.

Common FAQs about the 2025 OR-40 Oregon form

What if miss the filing deadline?

Missing the filing deadline for the OR-40 form can lead to various consequences, including late filing penalties and interest on any tax owed. It is essential to file as soon as possible, even if you cannot pay the full amount owed.

Can amend my OR-40 form after filing?

Yes, you can amend your OR-40 form after submission if you discover errors or omissions. To amend your return, use the appropriate Oregon tax amendment form and follow the instructions to ensure your amendment is processed correctly.

How do check the status of my OR-40 form?

Tracking the status of your OR-40 form is straightforward. You can check your submission status through the Oregon Department of Revenue's website or your e-filing provider, like pdfFiller, which often includes status tracking features.

Additional considerations for specific taxpayer scenarios

Certain taxpayer scenarios may require additional attention when filling out the OR-40 form. For instance, self-employed individuals must be vigilant in reporting all income and claiming relevant business expenses. Listing these accurately can help reduce overall taxable income.

For married couples filing together, determining how to report income can affect tax liability. It's important to understand the implications of filing jointly versus separately and to evaluate which option provides the best tax benefits. The treatment of dependents also necessitates careful documentation since this can affect eligibility for various tax credits.

Leverage pdfFiller for your 2025 OR-40 form needs

pdfFiller's platform provides a comprehensive solution for managing your 2025 OR-40 form. With features tailored specifically for Oregon tax forms, it simplifies the entire filing process from start to finish. Users can take advantage of its intuitive design, allowing for easy uploads of required documents and quick access to pre-filled templates.

Testimonials from users have shown how pdfFiller streamlines the tax filing process, allowing them to file with confidence and achieve their maximum tax refund. By integrating various document management tools in one platform, pdfFiller empowers taxpayers to handle their filings efficiently and accurately.

Best practices for managing future tax filings

To best prepare for future tax filings, organization is key. Create a dedicated space for tax-related documents and establish a routine for collecting receipts and financial records throughout the year. By doing this, you will avoid last-minute scrambles when tax season approaches.

Staying updated on changes to tax law is equally important. Subscription to state newsletters or utilizing resources from the Oregon Department of Revenue can keep you informed of necessary updates. Additionally, continuing to leverage pdfFiller will allow you to maintain an organized, user-friendly system for all tax forms.

People Also Ask about

How is Oregon income tax calculated?

How do I get my Oregon 1095 A?

What is a 10/40 form used for?

What is Oregon income tax?

Do I need to file Oregon state tax return?

How much tax does Oregon take out of my paycheck?

Where is taxable income on 1040?

Can I find my tax forms online?

Does Oregon have a state tax ID?

What form do I use to file my Oregon state taxes?

What is Oregon income tax rate 2022?

Are Oregon taxes high?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete OR DoR OR-40 online?

How can I edit OR DoR OR-40 on a smartphone?

How can I fill out OR DoR OR-40 on an iOS device?

What is 2025 form or-40 oregon?

Who is required to file 2025 form or-40 oregon?

How to fill out 2025 form or-40 oregon?

What is the purpose of 2025 form or-40 oregon?

What information must be reported on 2025 form or-40 oregon?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.